Insurance

Data-Driven Improvement to Better the Organization

Featured Industry

- Insurance Industry Module

- Expedite Claims

- Improve Retention and Customer Satisfaction

- Intelligent Underwriting & Predictive Analytics

- Implement an Improvement Program

- Customer Contact Center

- Service Quality Training

Insurance Industry Module

With Minitab's Insurance Industry Module, you don't have to learn statistics to analyze your data. Our solution allows you to collect data in real-time or analyze it later. You'll be able to easily interpret your findings to make improvements that help grow your top line, predict costs and improve customer satisfaction.

Let our solution make analysis easier, so you can concentrate on what really matters, such as improving key performance indicators (KPIs) like time to settle a claim, underwriting speed, revenue per policy holder, claims ratio and more. If you have any questions, we're here to help you every step of the way through your analysis. Simply reach out to our industry-leading technical support team via phone or email for assistance.

Expedite Claims

When customers make claims, they introduce uncertainty for insurance companies. Insurance companies must immediately record reserves on their balance sheet to account for the potential liabilities associated with the claims. Capital must be tied up to cover these reserves, which also means insurance companies cannot use that money to generate income. Claims adjusters must be deployed to deal with the case and customers grow frustrated waiting for a resolution. By expediting claims, companies can improve both profitability and the customer experience.

Improve Retention and Customer Satisfaction

At Minitab, we help you better understand your customers no matter where you are in your data analytics journey. Perhaps you already understand your customers and need to ensure your surveys are reliable? Or maybe you’ve just collected tons of information from your customers and need help analyzing it. Regardless, Minitab can help you better understand your customers so you can improve their experience and not only retain, but also grow their business with you.

Intelligent Underwriting & Predictive Analytics

Predictive analytics is a powerful tool that is gaining a larger role in the insurance industry. With increasing access to data, insurance companies now have the power to harness their data to make predictions and operationalize models to boost their performance.

Implement an Improvement Program

Developing an effective continuous improvement program takes a combination of skill, hard work and tools. Armstrong Flooring leveraged the capabilities of Minitab Engage to build and track training initiatives and projects, ultimately creating a robust and sustainable continuous improvement program. Learn from their success story and see how Minitab Engage can help you achieve your improvement goals.

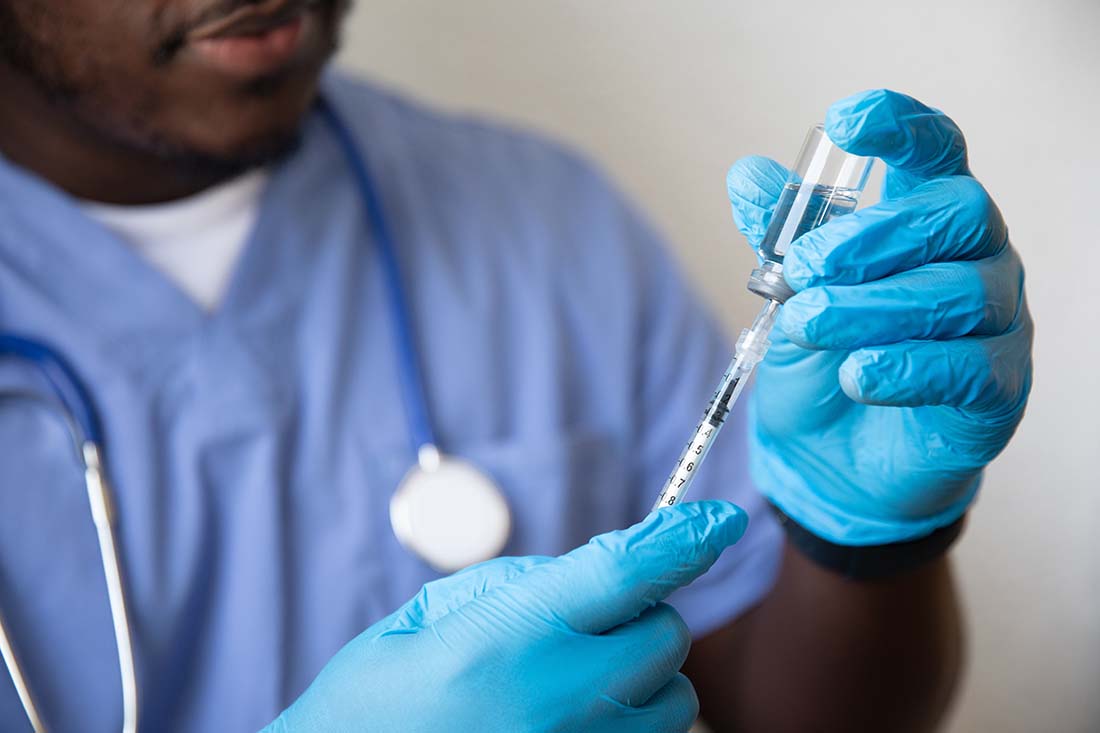

Customer Contact Center

Whether a company is interacting with consumers or other businesses, the customer contact center often serves as the first point of contact and impression for the organization. For insurance companies, after an initial policy purchase, the next customer contact may be during times of distress. It's crucial that the customer contact center delivers top-notch service, acts with efficiency and provides customers with the best possible experience.

Service Quality Training

Learn the data analysis techniques necessary to gauge whether processes are on target, explore relationships between variables and minimize defects, utilizing metrics such as time, ratings and revenue. Statistical principles will be presented through real-world examples and exercises, all supported by Minitab Statistical Software.

Leverage Data Analysis and Process Improvement to Improve Performance

With uncertainty surrounding interest rates and increasing competition, you need to find ways to increase productivity and boost your bottom line. Even if you have the smartest actuaries analyzing data about your products, premiums and risks, you need to leverage your organization's data to identify opportunities and assess risks. That's where we come in.

Minitab provides you with user-friendly interfaces that allow for deeper and more thoughtful data analysis.

Minitab’s solutions allow you to:

- Access your own data for analysis to drive improvements

- Identify key drivers of claims to expedite and predict future claims

- Grow revenues through a better understanding of your policies and sales effectiveness

- Predict and mitigate customer churn

- Leverage the power of Minitab’s algorithms to analyze credit risk, default risk or even event risk

- Improve performance processes and the customer experience all over your organization with structured problem-solving tools

DID YOU KNOW?

Over 70% of the Insurance Companies in the Fortune 100 partner with Minitab to improve their bottom line.

DID YOU KNOW?

100% of the Fortune 100 and Over 90% of the Fortune 500 Insurance Companies partner with Minitab to deliver innovation faster and operate more efficiently.

OUR CUSTOMERS

“Minitab created a corporate culture of complete transparency of information…Dashboard building is easy and accessible by all users…Don’t attempt to build your own solution, choose Minitab…”

Carrie B.

Insurance Broker